December 22, 2023

While there are multitudes of contact lens modalities for the presbyopic patient, many of which include specialty or custom options, what happens when there is an excellent option for your patient, but the price tag is too steep, and more budget-friendly alternatives did not or will not work for them? Some of these patients may actually qualify for medically necessary contact lens coverage with their vision insurance. Here is how to determine who is eligible for medically necessary benefits and how to navigate certain vision insurance plans along with the reimbursement rates from some insurance providers.

For the average patient utilizing their insurance plan and wanting contacts, there is usually a copay for, or percentage discount to, the contact lens evaluation and a nominal material benefit for the contacts. When billing medically necessary benefits, there is usually just a single copay that covers the evaluation and an annual supply of contacts that is significantly less expensive to the patient than if you were to bill the standard evaluation and material fees. Reimbursement rates to the practitioner are often higher for these benefits as well. For these reasons, I make it a habit to try and always bill medically necessary benefits if a patient qualifies. Both the patient and practitioner win with medically necessary coverage.

Who is Eligible for Medically Necessary Coverage?

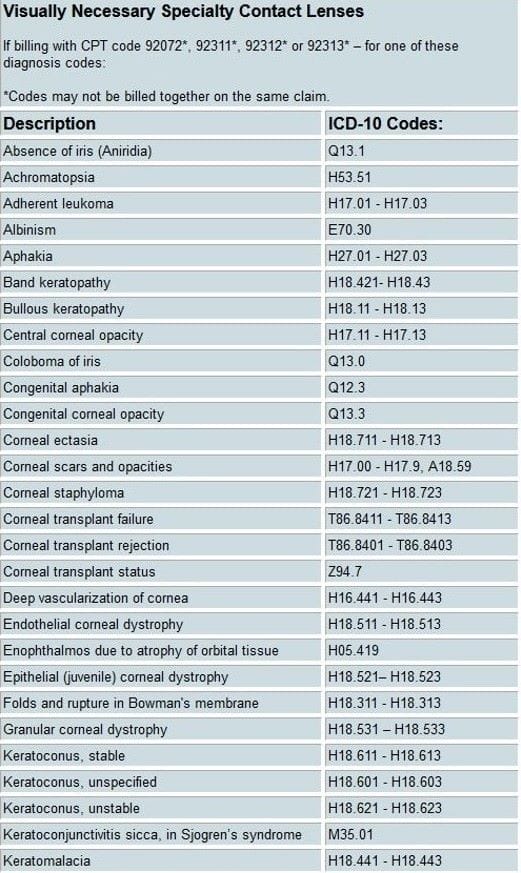

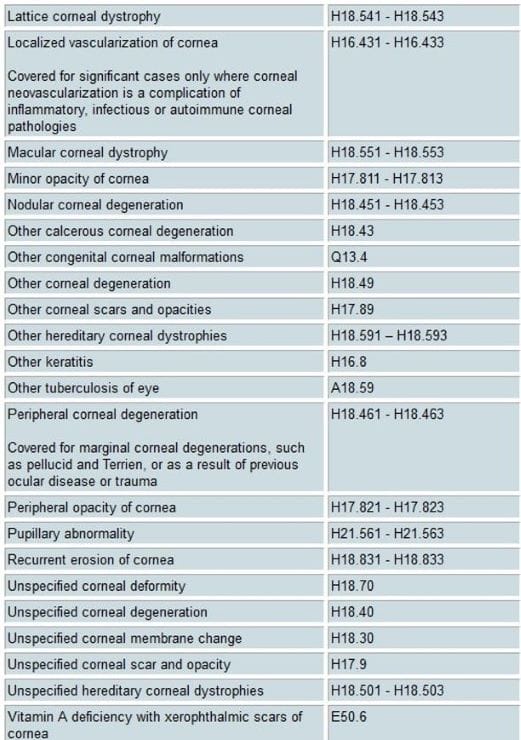

First of all, who qualifies for medically necessary benefits? In short, it depends on the insurance. Each provider has specific requirements in order for a patient to qualify. Most have coverage for keratoconus, anisometropia, and cases of “Vision Improvement,” where best-corrected vision is a specific number of acuity lines better in contacts than in glasses. Some also have coverage for High Ametropia (>/= 8D or 10D manifest ametropia depending on insurance plan). The most comprehensive coverage we’ve seen is from VSP (see the “Visually Necessary Specialty Contact Lenses” table below for qualifying ICD-10 diagnoses). EyeMed, Spectera, Davis/Superior, and NVA are other insurance providers that we have utilized medically necessary benefits from as well.

Check Reimbursement Rates

Some of these providers require the practitioner to fill out and submit a form in order to receive reimbursement. Reimbursement rates can be found by logging into each respective insurance carriers’ website. Depending on the provider, reimbursement rates are broken down either by condition or by lens type/modality. It is important to check what the reimbursement is prior to fitting a specific lens on a patient to make sure you’ll be able to cover the cost of goods and your evaluation fees.

We find that most eye care providers either don’t know about or just don’t utilize medically necessary benefits because we have new patients who come in and were totally unaware that they qualify for a nearly free year supply of contacts. So, what about that dry eye patient with -10.00 sph +2.00 add who couldn’t tolerate monthly lenses but couldn’t afford daily multifocals with their previous doctor? Or the post-RK patient with fluctuating vision in glasses or soft contacts? These are prime candidates to see if they have medically necessary coverage with their insurance plan, and they’ll be patients of yours for life when you are able to solve their vision problems at next-to-no cost. If you don’t typically bill medically necessary benefits, we bet that you’ve already seen a patient this past week who would have qualified, and we challenge you to look more closely at each patient’s plan.